Since we wrapped up week thirteen of the legislative session, much of our time is now focused on debating bills that passed through the final legislative deadline. With just a month left in session, our attention is also shifting to next year’s budget.

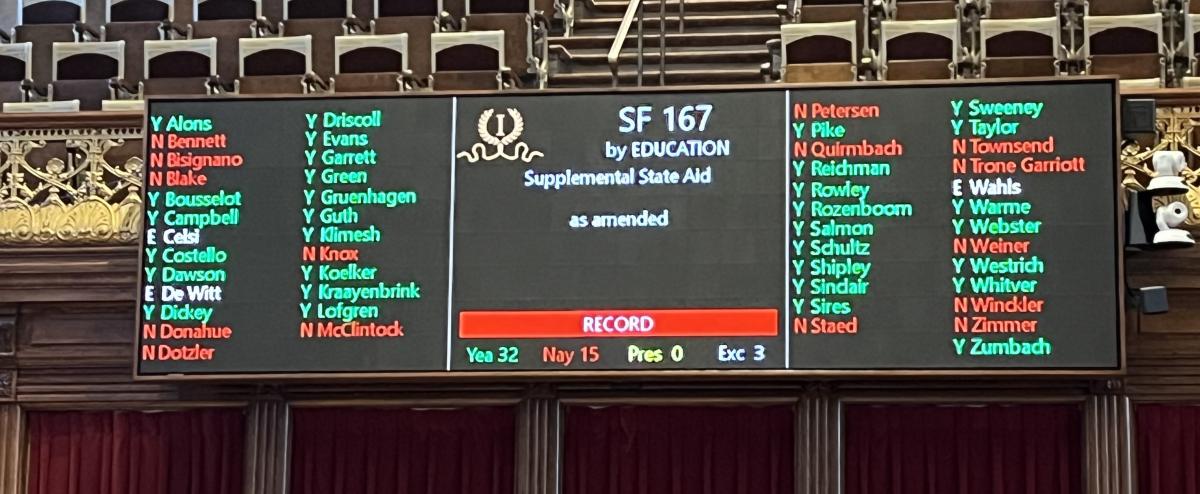

This week, both the House and Senate passed Senate File 167, establishing K-12 education funding for the upcoming year. The bill provides an additional $240 million, bringing the total general fund support for K-12 schools to over $4.2 billion—or $7,988 per student. It also includes the second year of the historic teacher pay increase passed last year, continuing our commitment to supporting Iowa’s educators and ensuring they remain among the top ten best-paid in the nation. This legislation reflects our ongoing dedication to responsible and sustainable investments in education.

To continue our education efforts, the Iowa Senate also passed House File 784 this week, the Governor’s Math Counts Act. This bill requires school districts to assess all K-6 students at least three times per school year to determine the level of math proficiency of students. It also helps ensure consistent evaluation and progress for students at risk of falling behind current standards. It allows for in-depth, personalized instruction to better address the needs of students who would require additional support. Along with the support for Iowa students, this bill supports teacher prep students, current teachers, students, and parents with the resources they need to improve math proficiency.

With education funding now set, the Senate also released our budget target for Fiscal Year 2026: $9.411 billion, a 5.2% increase over last year. This is the first full fiscal year under Iowa’s flat tax—now at 3.8% for all taxpayers. As we adjust to this and other pro-growth policies, we remain committed to conservative budgeting that focuses on our state’s priorities.

On Monday, the Senate passed Senate File 303, which updates local fireworks regulations. It permits fireworks on July 3 (9:00 AM–10:00 PM), July 4 (9:00 AM–11:00 PM), and New Year’s Eve (9:00 AM–12:30 AM on Jan 1). This bill ensures Iowans can continue celebrating important holidays at their own homes in the spirit of patriotism.

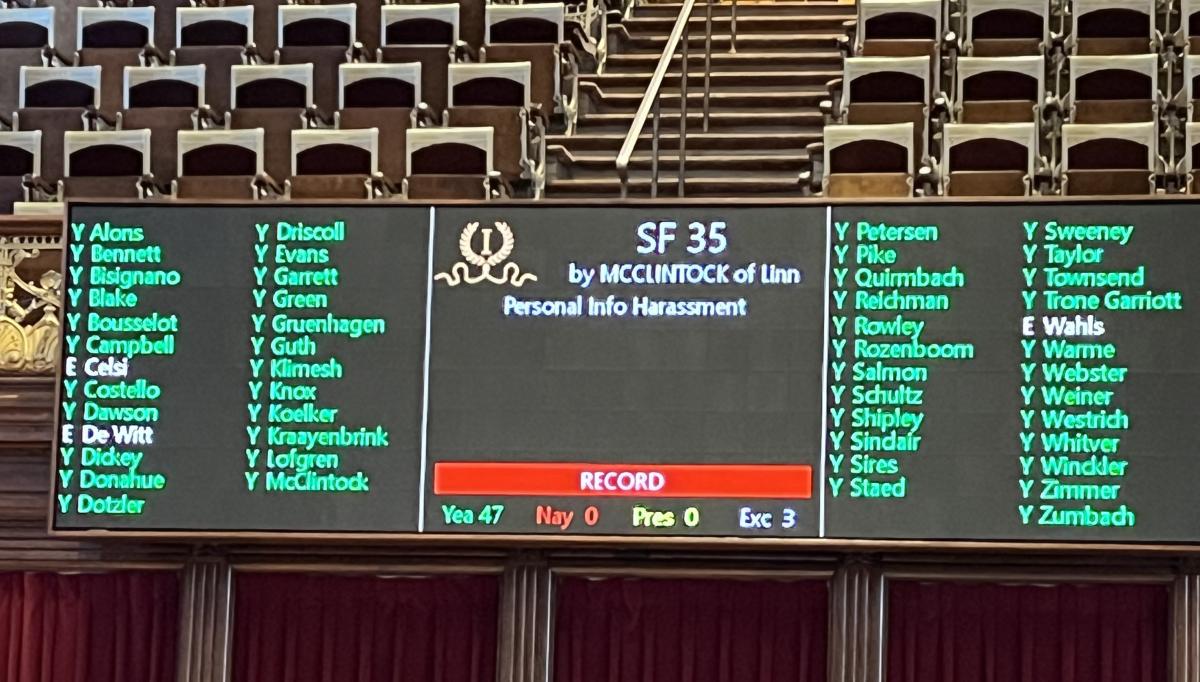

In an increasingly online world, the security of our personal information has become even more important. Oftentimes, personal information has been posted online publicly with the intent to harass, intimidate, or bully someone. To address this issue, the Iowa Senate passed Senate File 35. This bill creates the crime of harassment by dissemination, publication, distribution, or posting of personal information, otherwise known as “doxxing.” Violation of this law can qualify as an aggravated misdemeanor. This bill is a great way to ensure Iowans across the state are protected both online and offline.

Property Tax Relief Progress

In early March, Republicans introduced a historic property tax relief plan aimed at delivering the most significant changes to the system in decades. The goal is to create a better, more transparent process for property taxpayers, local governments, and businesses. The proposal included key provisions to bring more predictability, limit local government spending, and enhance transparency for those paying property taxes.

This week, we revised that proposal in response to input from Iowans, local leaders, and other stakeholders. Senate Study Bill 1227 reflects those updates. It raises the homestead exemption to $50,000, offering meaningful relief to residential property owners. The bill also eliminates the rollback for all property classifications—except agricultural—immediately, rather than phasing it out over five years. To help local governments manage during high inflation, it adds a consumer price index (CPI) adjustment alongside the existing 2% revenue limit. Finally, the bill includes support for smaller communities that aren’t seeing much growth, helping them maintain stability through the budgeting process.

Senate Study Bill 1227 builds on the original property tax relief framework and continues our efforts to support Iowans concerned about rising assessments, increased local spending, and the affordability of staying in their homes. A recent Common Sense Institute study highlighted the issue: “From 2000 to 2024 … property taxes grew at more than twice the rate of inflation – 170% versus 73%.” One of the report’s main findings further states, “If Iowa’s statewide property tax growth exceeds 2.3% annually, CSI forecasts Iowa will always remain one of the top half most burdensome states for local taxes.”

We continue to hear from Iowans who are feeling the pressure from rising property taxes and are worried about being taxed out of their homes. They’re asking for relief—and we’re listening. Work on this critical proposal is ongoing, and we remain committed to delivering real results for Iowa families while strengthening the state’s economic competitiveness and providing stability for local governments and businesses. Thank you to everyone who has offered feedback, questions, and ideas as we move this legislation forward.

Thank You District 42!

Comments

Submit a CommentPlease refresh the page to leave Comment.

Still seeing this message? Press Ctrl + F5 to do a "Hard Refresh".